Accident and Health Insurance Deduction - A Non-Taxable (or Pre-Tax) Deduction

Some employers deduct accident and health insurance premiums from their employee's wages. Such deductions are generaly not subject to taxation and are referred to as non-taxable or pre-tax deductions because they reduce taxable wages

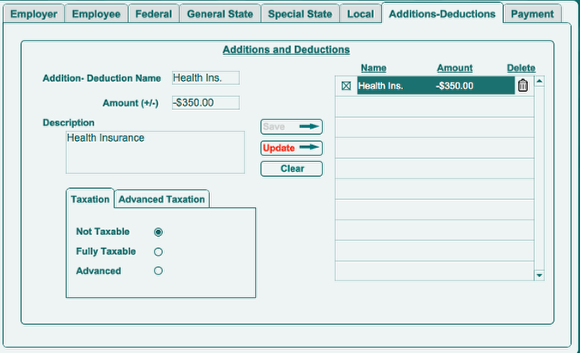

In the Additions and Deductions tab of Employer-Employee Settings, enter

- The name of the deduction;

- The amount (a positive amount for additional pay; a negative amount for deductions);

- A description if desired; and

- Select the taxes for which the deduction is exempt. In this example, the employer is deducting $350.00 of non-taxable wages to cover health insurance. Because the deduction is non-taxable, taxable wages for federal, state and local withholding calculations will be reduced by $350.00 each, thereby decreasing the employee's tax liability.