Non-Taxable Expense Reimbursement

Some employers choose to reimburse their employees for gasoline or other travel related expenses. These are added to the employee's pay as non-taxable additions.

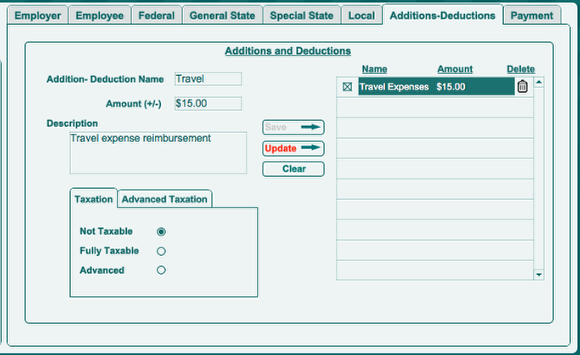

In the Additions and Deductions tab of Employer-Employee Settings, enter

- The name of the deduction;

- The amount (a positive amount for additional pay; a negative amount for deductions);

- A description if desired; and

- Select the taxes for which the deduction is exempt. In this example, the employer is paying the employee a non-taxable reimbursement for travel expenses.The amount of $15.00 will be added to the employee's net pay with no effect upon payroll taxes. When you calculate a transaction with a non-taxable addition, as illustrated here, you will note that the employee's "gross wages" do not increase. This is because expense reimbursements are not, for tax purposes, considered wages.